Imagine a sales graph that shows a beautiful upward trend. Not only that, but it continues to climb higher, even in the most stormy economic weather.

Some companies have already figured this out, and it’s safe to say it’s part of their secret to success. The answer lies in motivating a sales team to produce consistent results every month via an incentive called residual commission.

If the term is unfamiliar to you, read on. We’ll explain residual commission, how it can help your business, and some tips for getting started.

Residual Commission: The Basics

You might occasionally see residual commission called passive or recurring income. All those terms mean the same thing.

A residual commission is a type of compensation structure where individuals continue to earn income from work that was completed in the past.

It’s most common in industries where a new customer contract brings in monthly revenue for a company. That might include industries such as SaaS, network marketing, and insurance.

The sales rep continues to earn their commission until and if the customer cancels that monthly order.

The appeal of a residual commission structure lies in the potential for creating a steady, ongoing stream of income, incentivizing individuals to secure long-term customers or contracts.

What is the Difference Between Commission and Residuals?

While both commission and residuals are forms of income earned by sales reps or agents, they differ in their structure and duration.

Commission is usually a one-time payment a sales rep receives when they generate revenue for a business by making a sale or closing a deal. It’s typically a certain percentage of the price of the product or service sold.

On the other hand, residuals, also known as residual income or passive income, are recurring payments that a sales rep or agent receives over time for a sale or deal they secured in the past.

Residuals are common in industries where customers make ongoing payments for a product or service, such as insurance, subscriptions, or rentals.

The key distinction is that while commission is a one-time payment, residuals provide a continuous income stream as long as the account remains active.

Business Models that Use Residual Sales Commission Structures

For some business models residual commissions are the best sales commission structure. These are models that offer recurring revenue for a business.

The subscription model is a common one. With this model, a customer pays a fixed monthly subscription fee for a service. It’s common with music or video streaming, software, gyms, and some apps.

Insurance

In the insurance industry, an agent may earn a residual commission for policies they’ve sold.

If an agent sells a life insurance policy, they won’t just earn a one-time commission on that sale. Instead, they’ll earn a percentage of the customer’s premium payments for as long as the policy is active.

As such, if the agent sells multiple policies, they can accumulate a significant amount of residual income over time from their ongoing accounts.

Real Estate

In real estate, residual commissions are commonly used in property management.

A real estate agent who secures a rental property contract may earn a residual commission from the ongoing rental payments. For instance, if an agent rents out a property, they might receive a percentage of the monthly rent as their commission for as long as the tenant occupies the space.

This incentivizes the agent to find reliable tenants who will rent the property for a long term.

Additionally, some real estate agencies have tiered commission structures where senior agents earn a percentage of the commission from sales made by the agents they have trained and supervised, further enhancing the potential for residual income.

Such commission structures encourage experienced agents to mentor new entrants, fostering talent development within the agency.

Franchises

Franchising also employs the concept of residual commissions in its business model. Typically, a franchisor sells a franchise to a franchisee for an initial fee, who then runs the business under the franchisor’s brand.

The franchisor earns residual income through ongoing franchise fees, which are usually a percentage of the franchisee’s revenue. This percentage, often referred to as a royalty fee, is the franchisor’s residual commission.

It incentivizes the franchisor to provide support and resources to the franchisee as their success directly impacts the franchisor’s income.

Therefore, residual commissions in franchising create a symbiotic relationship, with both parties working towards mutual profitability.

Network Marketing

In network marketing, you’ll find that network recruiters earn a percentage of a sale made by any of the members they recruit.

This means that if you recruit a new salesperson to the team, and they make a sale, you will receive a percentage of their sales. Over time, as you recruit more individuals and they all make sales, these percentages can add up to a significant amount of residual income.

SaaS

In the SaaS industry, a typical example of residual commission could relate to a sales rep earning a percentage of the recurring revenue from a client they’ve brought on board.

So, as long as the client continues to use the software and pay their subscription fees, the sales representative will continue to earn from it.

This creates a steady, ongoing stream of income and incentivizes sales representatives to bring in clients who will stay with the company for the long term.

The Benefits of Residual Commission

For businesses, a residual commission structure offers many benefits. First, it helps retain customers.

Sales representatives have the incentive to build long-term relationships with potential customers. It avoids the quick win that won’t offer long-term financial rewards.

Long-term relationships also give businesses more loyal customers with the chance to upsell other products or services. It offers ample opportunity to grow a business from a stable client base.

For a sales rep, guaranteed income is an attractive proposition.

The sales effort happens once, but the income has unlimited potential to grow over time. It’s more lucrative for many sales reps providing they can secure those long-term clients.

If that sales rep continues to act as an account manager for that client, they may also benefit from additional sales commissions when upselling products or services.

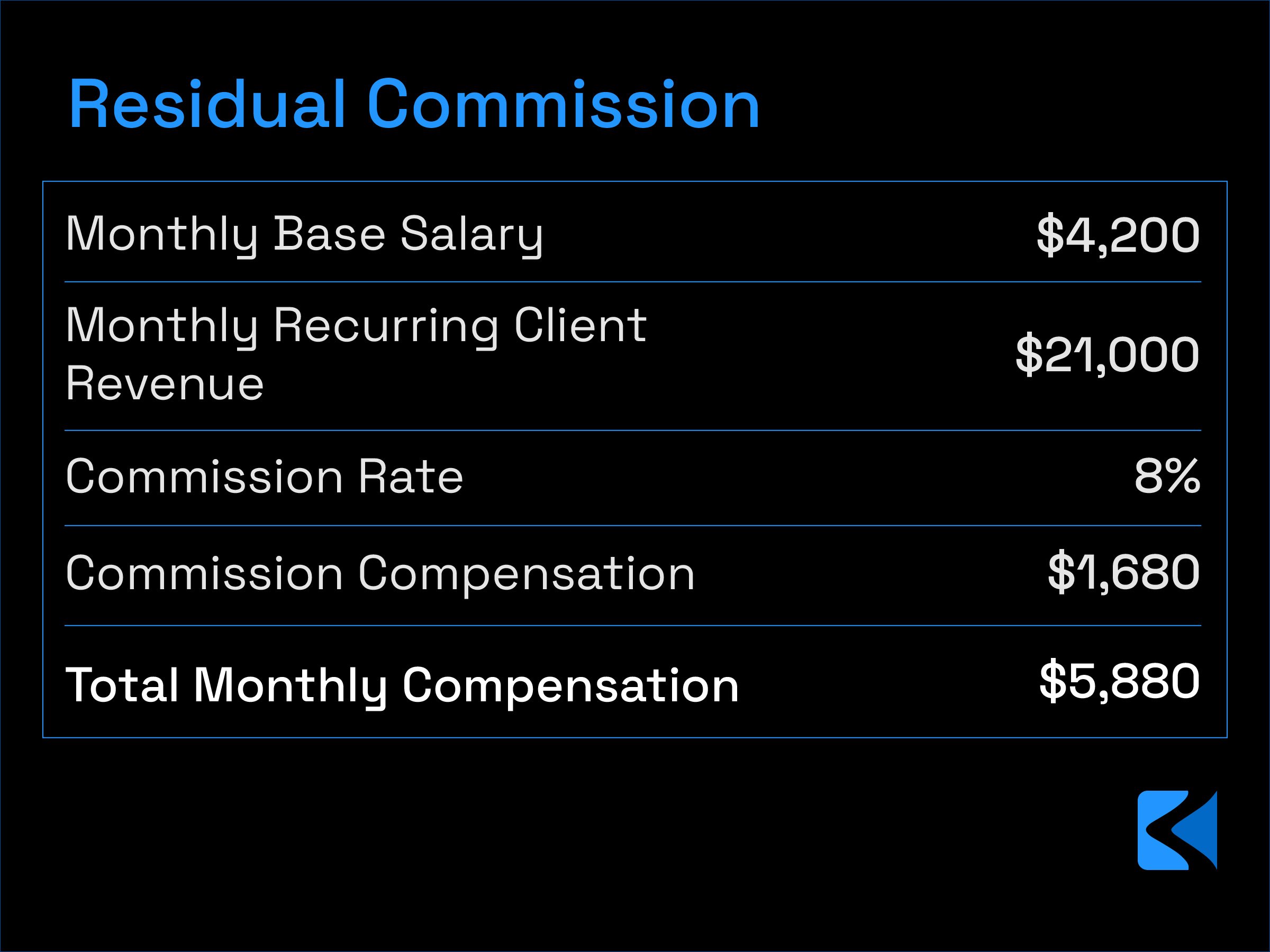

Sales Commission Calculation and Residual Commission

When calculating residual commission, you will generally use a percentage figure. For example, when a sale happens, the sales rep gets a 5% sales commission each month.

Alternatively, you can create a tiered commission structure with a higher initial payment followed by smaller ongoing payments. For example, the sales rep may get 50% in the first month, followed by 3% for each subsequent month,

When paying, you will typically set these sales commissions to settle on a monthly or quarterly interval, depending on how the customer pays.

Our Kinitro platform can help you set up the right sales commission plan for your business.

Keeping Track of Sales Commission Plan Payment Records

The biggest challenge for many businesses is keeping track of ongoing commissions due and payments made. It needs to be organized, and it can become unmanageable if you attempt to do this manually via a spreadsheet.

For most growing businesses, that takes too long, and it’s too easy to make mistakes.

Mistakes could cause many problems, such as losing the trust of a talented sales rep or overpaying too much commission and leaving yourself with a financial loss.

An automated tool like Kinitro is the best way to manage commission payouts. Since the system handles all this for you, you don’t need to worry about the detail.

Instead, you can rely on reporting functionality to give you a high-level overview of how your commission structure is performing.

Moreover, a platform like ours will help your sales team track their rewards. That will keep everyone motivated with the right financial incentives.

Common Challenges When Using Residual Commission

Residual commission can bring many financial benefits. However, you must understand some challenges to make the most of this sales commission structure.

The first challenge you face is financial forecasting. Since these payments are ongoing, it makes it more difficult to see how your future financial picture looks. A tracking tool will help with this.

A second challenge is inaccurate calculations. Under or overpaying your sales organization could cause problems for a business. For example, if you don’t stop a commission once a customer cancels, you could leave yourself with a financial loss.

You should also ensure your compensation plan doesn’t discourage your sales team from pursuing new customers.

If you want to grow as a business, you still need to focus on new signups as much as customer retention. Finally, you must be careful about delaying commission payments, which will demotivate your sales team.

Managing Risks

Always mitigate the risks that come with a residual commission structure. First, do the calculations upfront to ensure you get the right financial rewards.

If you miscalculate the long-term financial benefit of a customer, you could end up with a rewards system that’s overly generous and not profitable.

Secondly, make sure you have a process in place for handling commission pay disputes.

Even when you have a well-organized process, the occasional dispute will happen. Knowing how to address these disputes will save you from dealing with more complicated problems like legal claims.

Residual Commission: Making It Work for Your Business

Residual commission represents a powerful sales incentive that can drive consistent results and foster the growth of customer loyalty.

It’s an advantageous approach both for your sales team and the overall business, providing a regular income stream for the former and potentially enhancing customer retention and long-term profitability for the latter.

However, it’s crucial to manage it effectively, paying careful attention to accurate commission payments and ensuring a balanced focus between customer retention and new acquisitions. Using automated tools such as Kinitro can significantly streamline this process, making it easier to track, manage, and reward your team’s efforts.

In conclusion, a well-organized and carefully managed residual sales commission plan can serve as a key pillar of your business’s success, provided you navigate its challenges with foresight and precision.